Introduction - What & Why This?

At the beginning of each calendar year, I like to assess, compile, and write about the big themes and ideas I am thinking of. This piece should give investors a list of themes and setups to refer back to throughout 2025. The list should not be viewed as what I am personally long or short but as a list of ideas that one can have an edge in if a market/industry narrative or regime takes hold. As an investor, I would rather miss the first 20% of a rally to capture the remaining 80% if it means I have a 75%+ win rate versus trying to call a bottom with a sub-50% win rate. That is what this writing piece should help do; if a narrative starts to form, we already have the thesis written out and in the back of our heads and can jump on trades quickly.

The last thing before getting into the 25+ trades is why does the year-end mean there are 25+ new ideas? The economy, businesses, and industries do not suddenly change because the calendar year changed, and instead of 24, we say 25. Rather, the motivation for the piece is like anyone: the year-end, a reflection on the past twelve months, and coming into the new year refreshed, motivated, and reset with a bounty of ideas.

Now lets get into the ideas… The first 5 ideas have no paywall. If you’d like to subscribe, you can get 33% off forever when you sign up.

https://www.paxdexresearch.com/25TradesDiscount

Table of Contents

Macro Outlooks

Sort of an S&P 500 Outlook

Long, Long-Bonds

Thematic Ideas

Commercial Aerospace & After Market Aerospace

Data Centers Delivering Power Demand

Long Las Vegas

Payments Long Basket

Payments Shorts

Short Housing

Long Biopharma Supply Chain

Long MedTech

Demand Destruction & Supply Glut: Short Energy

Agentic AI

Finally Long Chinese Equities?

Single Stock Ideas

Long CP/CNI - Canadian Rails

Long CBL - Shopping Malls

Short TRUP - Pet Insurance

Long VRRM - Toll Roads & Speed Enforcement

Short NVDA - Hardware Competition

Long AGM/A - Capital Structure Arbitrage

Long FPH - California Land Bank

Long FVR - Outparcels

Long TTWO - GTA VI

Long HQY - Healthcare cont’d

Long TALK - Healthcare cont’d

Long SNAP - String of Catalysts

Macro Outlooks

1) Sort of an S&P 500 Outlook

S&P 500 year-end targets are always funny as they are taking way too much to gospel and relied on. The idea that just because we are going into a new year, should or does the economy change? Do businesses suddenly become more or less valuable? No. However, a year-end prediction allows us to think about all possible scenarios, not to predict what or when a particular scenario will play out. I say this because if we know of all the possible scenarios when they start to occur, we will have a framework and model already in place to capitalize on before other investors. I’d much rather be right >75% of the time by missing the first 20% of a rally but capitalizing on the remaining 80% versus being right only 25% of the time but making 100% of the rally. That said, I won’t spend too much time on my S&P 500 prediction. Still, a possible scenario I’ve been studying is the dynamic of international investors being a more significant percentage of capital in U.S. stocks than historically and the idea that the U.S. dollar appreciating is actually bullish for stocks. And for anyone who knows Econ 101, everyone is taught that an appreciating dollar is a negative for business since it makes trade more expensive, which is why the idea is contrary to popular belief.

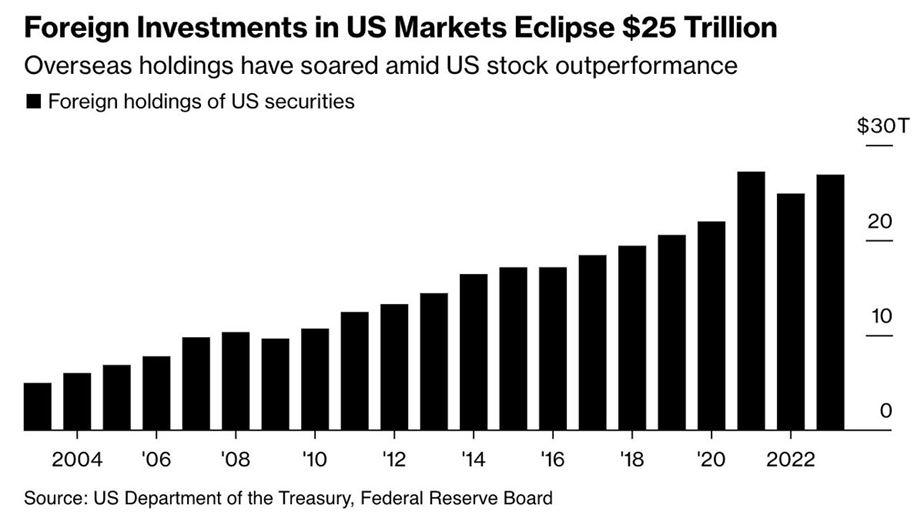

First, I'd ask why. Why are international investors investing in U.S. stocks at a pace higher than ever? Is it because the U.S. is leading in AI? Is it because the U.S. economy has been the most resilient in the world? Or is it because U.S. currencies have been devaluing? I think it's all of those, but the ladder is the most important to write about. We know that the U.S. is leading in AI as regulation has been little, and investing has been gigantic. We also know that the U.S. economy has been the most resilient large economy in the world, primarily due to our diverse GDP make-up. Still, it's hard to have a growth decline when you run the largest fiscal deficit of all time during peacetime. The United States' resiliency has allowed the dollar to outperform weaker countries, and even with fiscal debt looming, the dollar is outperforming.

Returning to how international investors piling into U.S. stocks creates risk because global investors get double the return on the U.S. while unhedged. This is because their countries' currency is depreciating compared to the dollar. Since international investors are buying U.S. stocks (denoted in the dollar), once they convert back into their countries, the dollar is giving them appreciation since it has continued to rise over the past few years.

However, with a Trump administration that would like to see the dollar go lower and a backdrop in which I believe bond yields will be going lower, the dollar depreciating is the likely outcome. In this scenario, you would have international investors losing purchasing power by owning U.S. stocks (since it is dollar-denominated) and would create selling pressure; now, couple this with declining U.S. stocks, and you get a yen carry-trade-esque selloff as we had in early August of 2024. I'm not predicting this, but it's something to think about if you get a scenario in which the dollar depreciates.

2) Long, Long Bonds

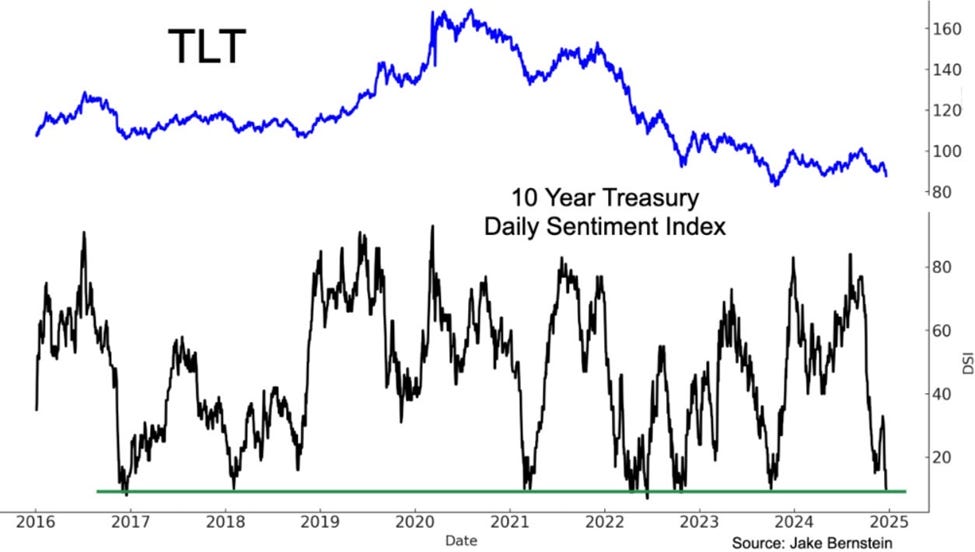

My most significant position, by gross size, is long-duration treasuries. You may ask why you would ever go long, something that has consistently underperformed stocks almost every year. 1) Few have followed the correlation between housing and the FED since 2020 2) It lowers vol 3) Long bonds are asymmetric vs stocks here.

Housing starts have led almost every major FED shift since 2020, and residential employment leads the FED and broader U.S. cyclical economy. Housing leads because the direction that starts go the direction residential employment goes, and since the FED is very progressive in its views and favors employment more than anything, a shift downward in construction employment is enough for the FED to let the doves fly to suppress the long end of the yield curve to try and increase housing supply (employment). With the 10-year at 4.6%, the volume-based public homebuilders cannot sell their supply in the sunbelt at today’s home prices. The over-supply in the South has been a clear shift I’ve been talking about for months, and we’ve been short of XHB and builders since May. Additionally, the hawkishness expressed at the last FOMC meeting has created the long bond setup well into 2025 as markets have little expectations of rate cuts (<2) in 2025, while I believe we will have 4+. Finally, in my opinion, we have seen a capitulation moment in sentiment on long-duration bonds, as most “strategists” have finally been extremely negative on long bonds in months.

Trading bonds are just as much as knowing sentiment as it is the fundamental backdrop of where rates could go, and today, you have a sentiment on your side to be long bonds.

Thematic Ideas

3) Commercial Aerospace & After Market Aerospace

Long: AER, UAL, WLFC, BA/AIR.FR For LT Investors

Short: FTAI

Aerospace has been in an unprecedented cycle since 2020, when airlines and after-market lessors of parts or aircraft have seen significant outperformance compared to commercial aircraft manufacturers BA/AIR.FR. Most of the 2010s saw the front of the value chain outperform, and the weaker parts, like airlines or lessors, whipped around year to year due to supply-side economics whipping up and down; supply gluts were frequent. Like any deep cyclical industry, airlines would consistently get too confident in prices or demand and continuously use excess profits to purchase new aircraft, open new routes, and book more dates, causing revenues and margins to compress via lower selling prices. However, in today's market, even if airlines wanted to blow up their pricing power ability by loading up on supply, they would not be able to. Why? Boeing and Airbus have each had manufacturing problems since 2020, and "problems," puts it lightly – more so for Boeing. Boeing is currently delivering ~31 737 platforms per month with an FAA cap at 38/month, clearly well below what even regulators allow them to produce. For more context, in 2018 (peak Boeing), they delivered 67 aircraft per month, implying that current build rates are less than half of past production abilities long-term. Moreover, the demand for aircraft globally has increased by double-digit percentage points since 2018 due to natural population growth, the aging of planes, and the globalization of third- and second-world countries. For even more context to illustrate how little supply there has been in commercial aerospace, from 2013 – 2017, Boeing delivered 3,644 aircraft, while from 2020 – 2024e, Boeing will deliver ~1,877 aircraft, a deficit from Boeing of > 2,000 aircraft, and his doesn't account for Airbus's lack of delivers that has added to the aircraft deficit. Moreover, there are even more supply constraints in the aerospace value chain, with a dearth of aircraft engines caused by the Pratt & Whitney GTF engine issue due to contaminated powdered metal. It has grounded ~350 planes, and 1,200 – 3,000 have needed to be inspected before being able to go back into operations. Moreover, the next-generation engines, like those manufactured, have had reliability issues compared to the older CFM56 engines. Combining all this, maintenance, repair, and operation (MRO) shops are fully utilized, and bookings are far out in the future. This forces airlines to lease spare engines from lessors, and we have seen used CFM engine prices rise exponentially since 2021. Simply put, supply and demand will take several years to come into equilibrium.

WLFC Pitch: What are ways to play these trends in commercial aero? 1) Overbooked MROs: specifically, what is most interesting here is companies tied with short-term leases to CFM56 engines, and the number one name that fits into that bucket is ticker WLFC. WLFC's portfolio of engine parts is 35% CFM56 engines, and 46% of those are based on short-term lease prices, with the remaining on long-term prices. The company trades at <8.0x FY25 EV/EBITDA vs. comps like AER, AL, or FTAI, all above that. However, the thesis does not require a multiple re-rating higher. As WLFC rolls over new CFM56 contracts at higher lease prices to the airlines, it stands to grow equity value considerably. The main risks here are MRO shop capacity can come online before the expected FY28 (Look at Safran's recent investor day), >50% of the company is owned by management that also runs the company and pays them self-handsomely (too much), and lastly, the cash conversion cycle for this business makes them continuously invest in capex during upswings so there is not much free cash generation at the moment.

Long the manufactures? Boeing/Airbus both are closer to troughs in build rates, then another ramp lower. Why? Everyone knows about all of the issues of Boeing's unions, P&W GTF, MRO capacity, and CFM's new generation of engine unreliability. Maybe something out of left field, like the GTF issue, could occur, but it is unlikely in my view. Moreover, Safran and other participants are investing significant amounts of capex into solving these problems. As new MRO capacity comes online and Boeing exits its restructuring, build rates are setting up to climb for Boeing/Airbus. Additionally, I do think sell-side #'s will come down for Boeing and Airbus, but the buy-side has already adjusted to these as the management teams have been outspoken in the lack of improvements in 2H2024. Aerospace cycles are very long-tailed, and with record backlogs going into the 2030s, Boeing and Airbus represent long-term GDP+ businesses trading at a cyclical discount in a secular aerospace bull market.

FTAI is another lessor but focuses on its module swap segment more than others. I have a few qualms yet to understand with this stock, and it's why it represents more of a short than a long. 1) How are they able to source OEM parts reliability before MRO shops? 2) I'm not an accounting forensic, but I have heard from PMs that FTAI's accounting is obfuscating when combining how management acts as a black box with the buy-side and the chance that FTAI might be booking all of the revenue/profit for multi-year agreements into one year (what Enron did). 3) Valuation is not cheap, at more than double the EV/EBITDA multiple than its after-market lessor competitors.

Another name in AM aero I like is Aercap (AER); excellent management with a long history of above-average returns in the industry. I think they can earn $15 in EPS in FY26; multiply that by a historical P/E of 9.0x, and you get a stock price of $135/share vs. today's $93.

4) Data Centers Delivering Power Demand

Long: TLN, AMSC

A third derivative of the AI revolution is power. While this isn't an undiscovered theme, some idiosyncratic catalysts for a few names make it worth writing about and tracking. I created a pitch deck on TLN in October, which you can find here – (insert TLN pitch). TLN sits on the generation side of utilities and operates in the unregulated PJM region, with half its generation coming from its crown jewel asset, the Susquehanna nuclear facility, which is the 6th largest nuke in the United States generating ~2.5 GW with ~2.2 GW being owned by TLN. Of this ~2.2 GW capacity, a little less than half is contracted out already to Amazon Web Services under a purchase price agreement (PPA), which means that a little more than half is still available to be contracted. The AWS deal was signed back in March of 2024 with MWh being sold in the low-mid $40/MWh, since then, we've seen Constellation Energy (CEG) spark a deal with Azure in September 2024 with MWh price in the low $100s. I think it's likely that TLN will be able to contract the rest of its Susquehanna nuke to a data center or power-hungry customer at a much higher MWh price than its AWS contract. And if you do the math on 1,200 MW of capacity * $100 MWh * 365 days, you get incremental revenue of $438.0MM or a 20%+ increase to today's total revenue for TLN.

Furthermore, Susquehanna has one of the lowest costs to produce per MWh at ~$25.00/MWh, implying that a deal with a hyperscaler at >$100/MWh would have operating margins of>75%. Additionally, revenue secured by long-term PPA's like the one with AWS is deserving of a higher multiple that deals with residential or traditional C&I customers because this is one of if not the highest value customers you can serve, a customer that will always need 24/7 power rain, snow, or heatwaves and has the cash flow to pay high prices for the highest quality power source - which is nuclear. Moreover, some idio catalysts for TLN will be since it came out of bankruptcy just a couple years ago there will be several credit rating upgrades over the coming years to lower its interest expense materially. Additionally, as Talen has a longer time frame as a public coming (just uplisted to the Nasdaq in July) and continues to have GAAP profitable quarters, it will be up for more index inclusions like the Russell 1,000, S&P 400, S&P 600, and ultimately the chance to get into the S&P 500/XLU.

A few other power names to look into are NBIS (recent IPO special situation), MXL, and AMSC, which sells widgets that can be used to expand the interconnection grid, which is way behind in upgrades. Just look at the interconnection queue that didn't exist 5 years ago.

5) Long Las Vegas

Long: RRR, SPHR

A mini mega-trend I am very bullish on is the city of Las Vegas and businesses that have exposure to its growth. Las Vegas is a top 5-10 city in population growth every year, one of the most affordable cities, top 5 in income growth, no state income taxes, Vegas will get an NBA team this decade, Hollywood is trying to relocate to Vegas, and more mega events like the Super Bowl or F1 are taking place each year.

You could play this trend in several ways, but I'd bucketize it in three ways. 1) Las Vegas Strip casinos/resorts, 2) Non-Strip casinos/resorts, and 3) another bucket – Like SPHR.

Where will most of the value accrue for companies with exposure to Vegas? I'd urge investors to avoid Las Vegas strip operators since it's highly competitive, and much of the gains accrue to their labor unions (similar dynamic with UPS). However, what has some idiosyncratic qualities are regional casinos/resorts. 1) Regional operators benefit from the unions on the strip as many of them cooks/cleaners/staff that receive the high wage increases live on the outskirts of Vegas and, in their free time, often visit the regional casinos/resorts like Red Rock Resorts (RRR). RRR only focuses on the Las Vegas Local regional casino/resort market. Moreover, the company has a multi-decade history of operating in the Vegas Local market, with new developments having an average IRR >20%. The most recent example of their new Durango location in West Las Vegas was built for ~$780.0MM and will do >$125.0MM in EBITDA by 2026. Not a bad return by year 3 of being open. Red Rock has the highest quality and newest properties in the regional market (take a look at Red Rock Resorts, Durango, and Green Valley Ranch). Another unique advantage for Red Rock is its land bank; the company owns about ~$1.0 billion acreage throughout the Las Vegas Valley, with prime acreage in Skye Canyon and Inspirada for subsequent development like Durango. Red Rock has a decade+ runway to build Durango-like properties throughout Las Vegas, all while benefiting from MSD growth coming from the population + income growth of Las Vegas Locals. Recent temporary headwinds over the past few months have been an overhang, with the stock 27% off its highs. Temporary headwinds have been FY25 being a reinvestment year into properties with ~$200.0MM in capex being unexpected maintenance, and it will impact FY25 EBITDA by ~$22.8MM (~4% of EBITDA). Moreover, fears around margin contraction are overblown as the increase in EBITDA margin compared to FY19 is structural, as most of its cost was taken out from promotion and buffets that will not be coming back. Additionally, historical seasonality has come back after FY22/FY23, being abnormal during the boom out of lockdown; historical seasonality is making comps tougher. Moreover, in 4Q24, F1 has hard comps YoY, and in 1Q25, Red Rock will be comping for the Super Bowl that was in Las Vegas in CY24. All of these headwinds (there are many, yes) are temporary, and underneath them, you have a secular growth story that bets on Las Vegas's growth. RRR trades 9.6x FY26 EV/EBITDA, an attractive entry point for long-term investors. Lastly, one potential catalyst that could reignite investor interest in Red Rock in CY25 is if no tax on tips is signed into law. If no tax on tips is signed into law, it will save Vegas Locals ~$200.0MM in savings and Red Rock ~$2.0 – 3.0MM in payroll taxes.

Keep reading with a 7-day free trial

Subscribe to PaxDex Research to keep reading this post and get 7 days of free access to the full post archives.