A NICE Opportunity; Buy $270 PT (No Paywall)

Why NICE stands to emerge as a leading inference AI beneficiary while currently trading below its intrinsic value due to one-time headwinds that will dissipate.

For all readers, I recommend opening the docsend file below this paragraph. The file is titled "PaxDex Research—A NICE Opportunity; Buy $270 PT” It requires no email to view and is in a much better format to view than on Substack. However, I've typed it out for those who’d like to view it here. As always, Feel free to ask any questions!

PaxDex Research—A Nice Opportunity; Buy $270 PT

INITIATION INTRODUCTION

A NICE Opportunity; Initiate at Buy; $270 PT

I am initiating coverage on NICE LTD (NASDAQ: NICE) with a buy rating and a $270 price target or 21x 2025 FCF on my estimates. NICE will be an immediate inference AI beneficiary where the market is discounting the opportunity driven by one-time unexpected headwinds like the CEO abruptly retiring that will dissipate within the next twelve months (NTM), making it one of the most undervalued “AI stocks” that the market has to offer. I believe that over the NTM shares will reprice to 21.0x FY2025 FCF from today’s 14.1x multiple, implying $270/share, representing ~49% upside

Long-Term EPS Growth Drivers

1) GenAI Adoption

2) Acceleration of Cloud Migration

3) AI Productivity Tool (Co-Pilot)

4) Market Share Gains via Weak Competitors

5) Accretive Share Repurchases

CCAAS IMPORTANCE

Contact Center as a Service Vital Importance

Without a contact center millions of businesses would be unable to operate, and without a mission critical cloud contact center solution like NICE CXone, businesses will lose customers and market share to competitors who adopt a cloud contact center. For readers, I think it’d be helpful to illustrate the importance through examples rather than buzzwords like mission-critical, vital, and describe what the cloud actually means for a contact center, but what it is keen to understand is that without a software solution like NICE, businesses in industries like hospitality, healthcare, telecom, insurance and more B2C industries will lose market share to competitors that do adopt a software solution like NICE's cloud products vs staying on-premise with licenses. In the following paragraphs, I will describe what a contact center is, its importance, and the on-premise vs cloud debate.

What is a contact center? A contact center is where call agents work out of, if you’ve ever seen in a movie, commercial, or picture a massive floor of cubicles/desks and all employees with headsets constantly on the phone, that is a contact center or known as call centers.

What does a contact center do for an enterprise? Contact centers serve different roles for each industry, but what is all the same is that they increase customer satisfaction, which in turn increases the revenue that the customer will return to the enterprise. Companies like Verizon use NICE CCaaS software in their call centers to enhance customer interactions. For axample, when an inbound call comes in, NICE software has the ability to analyze the customer's voice, tone, and words in real-time. If the customer expresses interest in switching providers or learning about new products, the software automatically suggests relevant products or promotions to the agent. This allows the agent to upsell effectively, offering items by the SKU, price, and promotion details.

On-premise vs cloud solutions? Like many other software's over the past decade+, there has been an ongoing transition from on-premise licenses to cloud subscriptions. It's essential to understand why this transition is occurring and what could slow or accelerate it. Historically, before the cloud, if your enterprise had call agents, you would have software licensees that were individually installed into each computer to act as the software for your call agents to do their job, and it's a very similar software to the cloud subscription software. Where problems arise and why the transition from on-premise to cloud is so vital for enterprises is that cloud solutions offer unparalleled scalability and flexibility. It reduces IT overhead and enables remote work when you're on the cloud vs. on-premise. For example, suppose I run an online apparel store like Nike, Abercrombie, Lululemon, etc., when the holidays are around November and December. In that case, I will get more inbound calls for returning items, promotion details, inventory checks, etc. This means that I will need more contact agents, and more seats mean more software needs to be used, which is easy to add with a click of a button when you're on the cloud. However, if I am on-premise to increase contact agents and equip them with the software to do their job, I need a license installed on a computer via NICE, which can take away crucial time from helping customers. Furthermore, when on-premise software is being used, it means the enterprise has its own in-house IT teams with servers running. The problem is that those servers have bandwidth limits like any server and are very costly to run. Whereas a cloud solution is hosted by a company like AWS, Azure, or GCP and has no risk of breaching bandwidth limits. Imagine if you were a business like Nike during the holidays and couldn't take any more inbound calls from customers wanting to buy items because Nike's in-house servers reached their bandwidth limits. You are likely to be frustrated as a customer and Nike just lost your business. Moving your contact center to the cloud is mission-critical for success.

COMPANY OVERVIEW

The History of NICE

NICE was founded in 1986 by a group of Israeli engineers who initially sought to commercialize and target international defense markets via the development of telecom software systems that were used to detect, locate, monitor, and record radio transmissions. Following the end of the Cold War, NICE realized that its TAM would rapidly shrink, so the founders looked for new markets: civilian (the start of the NICE that is today). By the mid-1990s, NICE had become one of the first companies to offer the capability of recording large numbers of simultaneous telephone transmissions and recorded telephone numbers with time stamps. This product was provided to enterprises as voice communication logging and recording systems, which are still used today by millions of call agents, especially in industries like automotive, where salespeople can automatically record your information in an orderly archive to increase sales efficiency. NICE’s breakthrough was in 1995 when it received its first large-scale civilian contract for $30mm with the FAA. Hence, it began; NICE’s first commercial product (NiceLog) was installed in every U.S. airport to help contact agents, and in 1996, it became listed on the Nasdaq, and the commercial deals started flowing in. In the subsequent years, NICE continued to develop and acquire other technology companies and by the end of the decade had a suite of products in addition to NiceLog things like call center quality control and the monitoring of employee productivity, employee training software, VoIP, statistical tracking, and entered various new industries like public safety/governments and by the early 2000s had fully exited the defense markets. NICE further broke through and got closer to what it looks like today in 2004 when it released its product, Nice Perform. The differentiation in the new software product was its ability to track many new variables in a customer’s call. Nice Perform was able to track the vocabulary, tone of voice, and emotional condition to provide call agents with the best course of action to help respond to customers with higher satisfaction. In 2007, NICE acquired Actimize for $280mm, which today represents the NICE Financial Crime and Compliance (FCC) segment making up ~20% of revenues. Over the next seven years, NICE made turnkey acquisitions to add features to its software, like customer feedback, collecting real-time customer experience information, and more analytic capabilities. In 2014, Barak Eilam (current CEO) became the CEO, and NICE relocated its headquarters to New Jersey. In 2016, NICE acquired InContact for $960mm in a “bet the company” move to make NICE a leader in cloud contact center software (CCaaS). In 2018, NICE acquired Mattersight for $90mm to provide behavioral and cloud analytics. In 2019, NICE acquired Brand Embassy, which allows NICE to manage customer interactions across social media platforms such as Facebook, Instagram, etc. In 2021, NICE acquired MindTouch, a knowledge management business, and in addition, NICE partnered with Google Cloud to create a more effective customer service application for contact centers. In 2023, NICE rolled out its AI product offerings called Enlighten Copilot and Enlighten Autopilot. Enlighten Autopilot is what you think of when you hear call agents will cease to exist; it is an AI-enabled product that entirely removes the call agent, increases NICE ARPU, and saves the enterprise significant labor costs. Enlighten Copilot are tools that enable call agents to be more productive, which means that fewer call agents are needed for the business to operate. Barak Eilam retired in 1Q2024, and NICE recently announced that Scott Russell would succeed him on January 1, 2025. Scott has a long history in enterprise software, and I believe the transition will be seamless. To sum it up, NICE has a long history in the contact center space, and each technology cycle has innovated or made acquisitions to position itself as a leader. I believe that will continue through the upcoming AI adoption cycle.

Segment and Geographical Breakdown

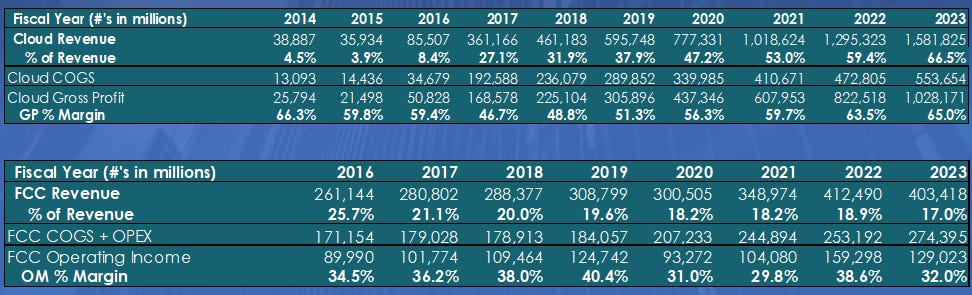

1) Cloud: This is the NICE growth engine, and it's the product I've talked most about thus far, offering call centers customer engagement solutions like (AI/ML products), workforce optimization (WFO), which ensures that call agents are productive, advanced analytics which I described in the Verizon customer example on page 4, compliance solutions, and more features that are all cloud-based. The other component of the Cloud segment includes (FCC) Financial Crime & Compliance: What does that look like? NICE, at heart, is an analytic company through its origins in call centers, but taking this core analytic expertise to a market that is troubled by fraud (financial industry), NICE has built a multi-ten-figure business unit that produces 30%+ operating margins. This segment was founded in 2007 when NICE acquired Actimize for $280mm. This business unit aims to help prevent market abuse, financial fraud, and money laundering. Additionally, the segment ensures that financial firms follow compliance in real time, either approving or denying transactions/decisions based on a compliance framework. NICE Actimize will analyze and collect data points for each situation and format it into a dashboard that is in layman terms to understand the options you can take for each financial threat. Moreover, FCC incorporates NICE AI/ML expertise, enabling the detection of patterns and anomalies indicative of financial crime. Growth drivers for this segment include the secular change from legacy branch banking to digital/neo banking. As consumers increasingly switch to digital banks, they inherently have higher crime risks, such as identity verification and customer financial behavior, and banks need to provide quick verification to satisfy consumer wants. It's a slower-growing segment than Customer Engagement but is a secular grower. NICE does not break out cloud FCC and Customer Engagement revenues from on-premise maintenance/product revenues, so it's hard to estimate what % of cloud revenue is FCC vs Customer Engagement (call center). However, I estimate that cloud revenue is a ~75/25 mix between Customer Engagement and FCC. Cloud revenues have grown at a CAGR of 21.6% since 2019 and will continue to grow at a high teens rate in the coming years.

Segment and Geographical Breakdown, LiveVox Acquisition

2) Services: The second segment, Services, is mostly maintenance revenue for legacy on-premise customers. This segment is in secular decline but more than offset by cloud growth. In fact, about a third of NICE cloud growth comes from existing on-premise customers switching to the cloud. And net, when a customer conversion occurs, NICE makes more money as they can charge more via the cloud and make a much higher margin than on-premise sales. Services for on-premise customers include support to address all stages of the technology lifecycle, including defining requirements, planning, design, implementation, customization, optimization, proactive maintenance, and ongoing support for updates. This segment is less critical, and for modeling as cloud revenue ramps quicker, I decrease the Services segment equally.

3) Product: The last segment is also related to on-premises; the physical licensees and other products are unimportant to the long-term growth thesis. For the sake of readership time the only thing to know is that this is a secular declining segment and is modeled similar to the Services segment. Lastly, on average, the ARPU of a cloud customer is >50% higher than on-premise, demonstrating the high ROI of conversion to cloud services.

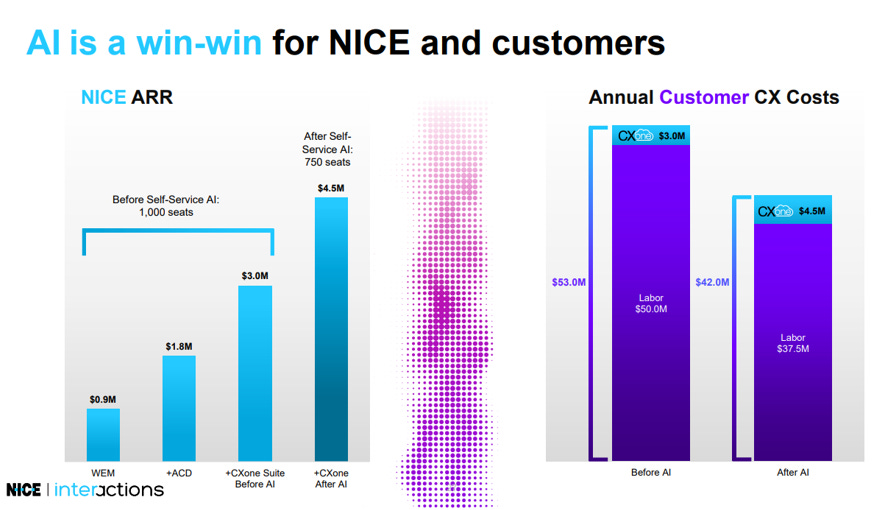

Below is the historical data on NICE’s geographical revenues.

In October 2023, NICE acquired public company LiveVox for $424mm, funded entirely by on-hand cash and cash generation. LiveVox allows NICE to break into outbound call technology, whereas previously, NICE was known solely for inbound calls. The acquisition is accretive to EPS and FCF in year one, and the synergies are relatively easy to picture. On the cost side, LiveVox was a public company with many G&A costs to take out, and on the revenue side, there are significant cross-selling capabilities as this is a NICE break-in point into outbound calls.

GROWTH DRIVERS & COMPS

Growth Engine Fueled by Auto Pilot, Cloud Accel, and Co-Pilot Adoption

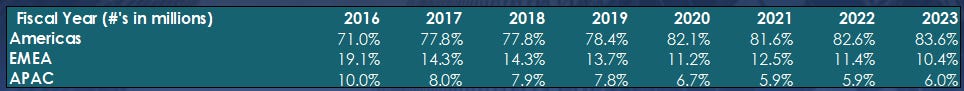

Growth Lever #1: AI inference impact for NICE will create a higher margin business and make it one of the fastest-growing public cloud stocks at scale. With the evolution of LLMs in recent years, NICE has been at the forefront of development, and with the most data in the industry, analyzing 2 trillion call center words per month, NICE has built a leading “auto-pilot” product that will replace call center agents in the millions through 2030. I believe that autopilot alone will represent 32.4% of NICE revenue by 2030, vs today at 7.2%, and it will grow at a CAGR of 41.6% through 2030. Below is an example of how enterprises save when they choose auto pilot.

Growth Lever #2: Enterprise CCaaS cloud adoption is in its early innings and is being accelerated by AI adoption. Moving off on-premise is essential within the contact center industry as it allows for the simple scalability of volumes, which is a must for top service, and this is just one of the benefits as described more in-depth earlier. Additionally, to host any AI features, an enterprise must be based on the cloud, which is driving conversions, and with just 25% of the enterprise contact center industry on the cloud, according to Gartner, the cloud transition story is in its early innings with teens+ growth for several years.

Growth Lever #3: Like the 1st growth lever, the rapid development of LLMs has allowed NICE to build a leading GenAI co-pilot product offering to call agents. The product increases call agents' productivity to the point that an enterprise only needs fewer call agents to service the business. Furthermore, the NICE co-pilot allows calling agents to increase customer satisfaction and revenue per customer, whereas, without a co-pilot, an enterprise will lose out on potential ROIC.

History of Competitors Losing Share + Cash Generation = Buybacks

Avaya is a competitor in the CCaaS market, that had a MSD – HSD market share % and went bankrupt in 2017 due to a significant amount of debt due to a failed LBO by private equity firms. This allowed existing financially capable companies to grab up share, which included NICE taking share. Furthermore, Five9 has about HSD % market share in CCaaS and has been significantly unprofitable for several years. With growth slowing down at the company due to its SMB market being much more penetrated than enterprise, and the stock price down significantly, it puts the firm in a financially troubled position to invest in R&D and turnkey acquisitions, as to raise equity or debt the opportunity cost is considerably higher than NICE’s. I believe that companies like Five9 in the CCaaS space will continue to lose share, which will help NICE maintain or increase its market share.

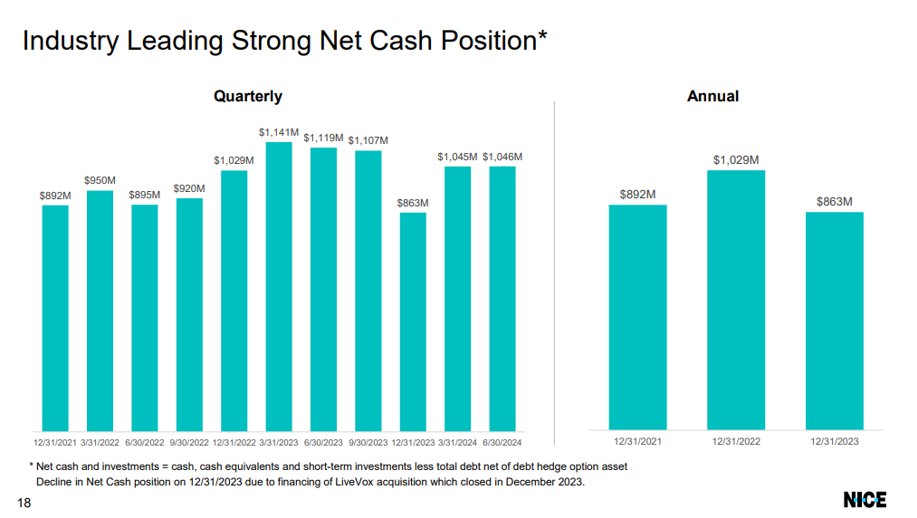

NICE has been increasingly free cash flow generative over the past several years and it’s at a tipping point of an extremely depressed share price and all time high FCF. As it stands today, NICE is set to buy back ~4.00% - 5.00% of shares outstanding over the next twelve months (~55% of FCF used), a move that will significantly drive EPS growth. Moreover, NICE maintains a high level of net cash, providing it with the financial strength to turn the ship quickly, whether that’s through an acquisition like LiveVox or heavy investment in R&D, a strategic advantage that some of its competitors lack.

GENERATIVE AI SCENARIO'S

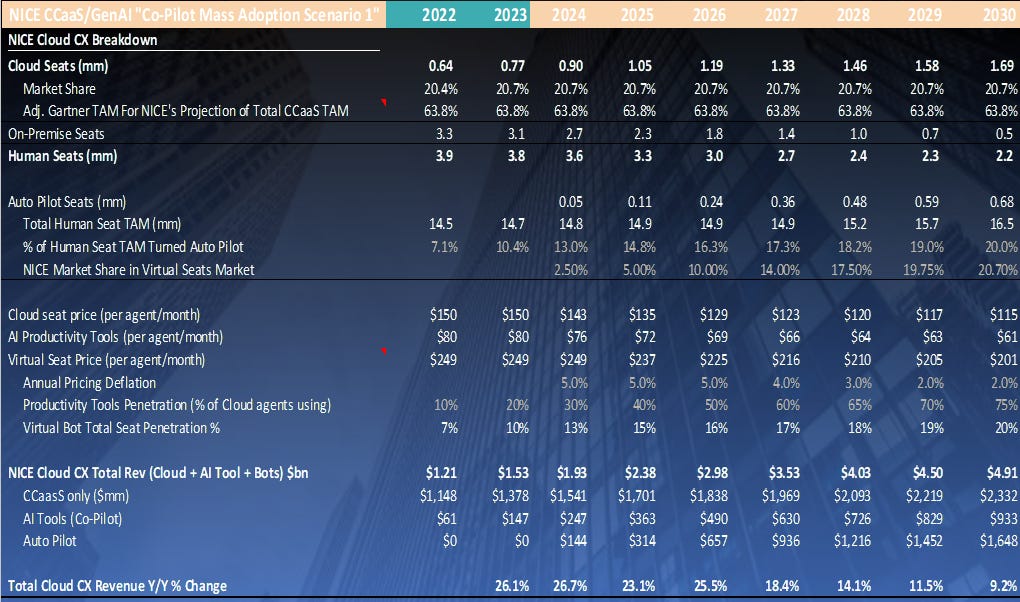

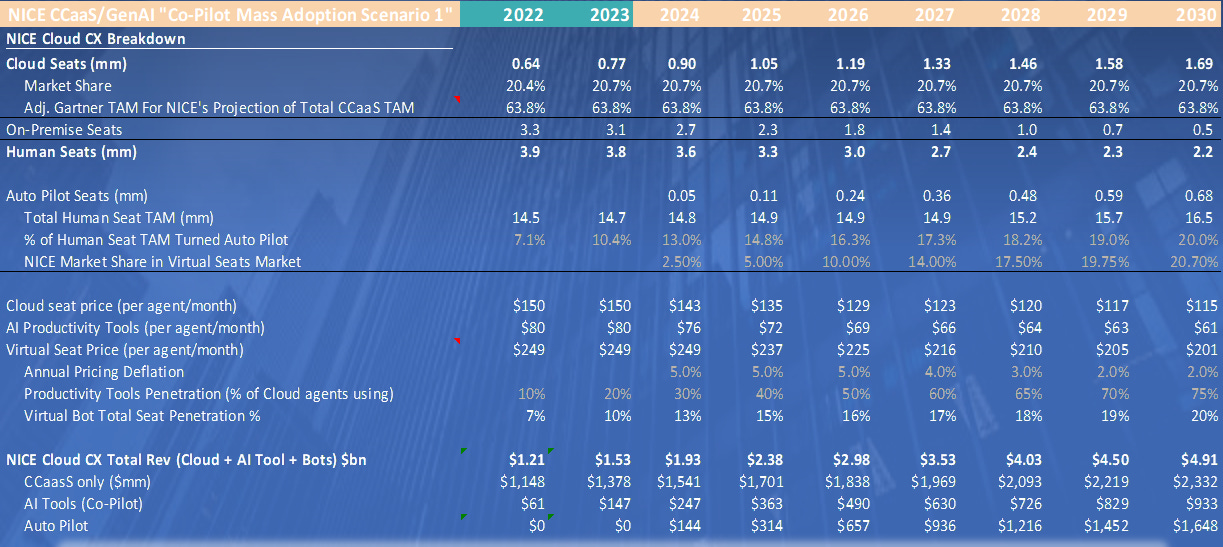

Scenario #1 | "Co-Pilot" Mass Adoption by 2030

Below is my framework for estimating NICE existing and future cloud revenue. Notable, it is not 1:1 with NICE’s reports, but it’s modeled as close as possible and has a positive correlation above 90%. I’ve built three scenarios of how I view the three most probable outcomes for the CCaaS industry over the next several years. To better understand the projections, view the model while looking at the them below.

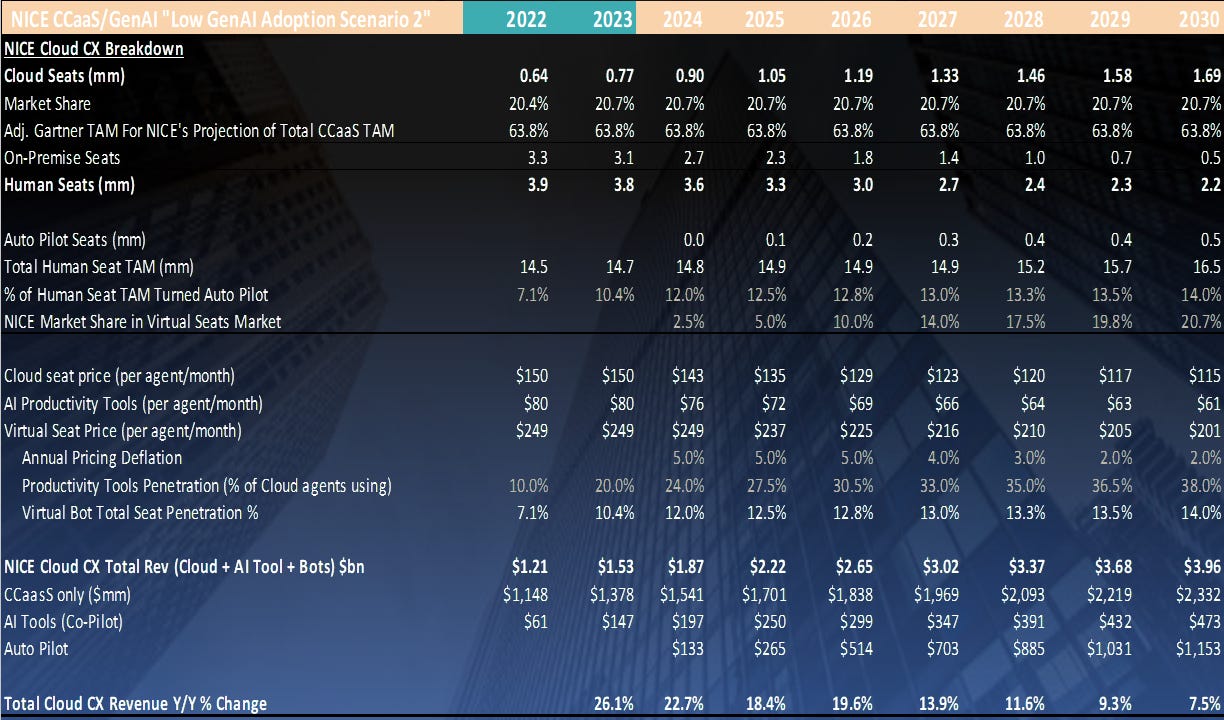

Scenario #2 | "Low GenAI" Adoption by 2030

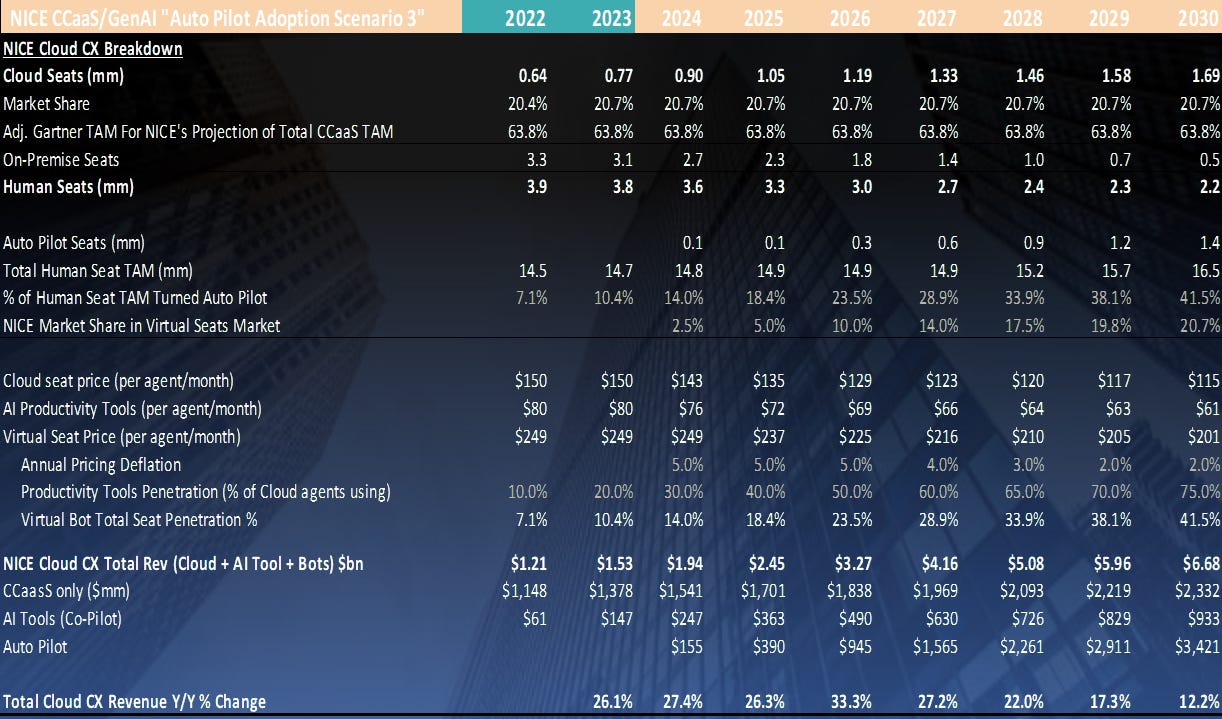

Scenario #3 | "Auto Pilot" Mass Adoption by 2030

MODEL ASSUMPTIONS

Mass Co-Pilot Adoption, Modest Auto-Pilot, Accel in Cloud

In my model I assume Scenario #1 as the base case and most likely. It’s assuming that their will be mass co-pilot adoption with 75% of NICE served contact agents by 2030 using co-pilot, modest auto pilot adoption with 25% of human seats replaced by 2030, an acceleration in the conversion of on-premise call agents to cloud with ~85% of human call agents being cloud based by 2030 vs the ~25% that it is today, and conservatively projecting pricing deflation although none has occurred over the past two years. I think what’s very keen to understand is that the APRU for auto-pilot is very early to project and early estimations on deals have been $1,000+ per previous seat. However, in this projection I assume $249/month to be conservative with 5% pricing deflation per year. Additionally, cloud add ons and auto pilot additions increase the profit margins for NICE as the incremental cost attached to adding a new auto pilot “seat” are <5.00% of the revenue received. Below is the framework for how I model NICE’s cloud growth. Below is the bulletized version of all the assumptions that go into my DCF for projecting revenues and costs.

1) 75% of contact agents by 2030 are using a form of Co-Pilot

2) 85% of contact agents are cloud based by 2030 (~25% today)

3) 5% pricing deflation per annum across every product

4) 2024 $249/month auto-pilot, $76/month co-pilot, and $143/month for a cloud seat

5) COGS decrease 2% per annum as incremental GenAI products come with high margins

6) On-Prem revenues decline at a CAGR of 11.6% through 2030 and NICE has static mkt share

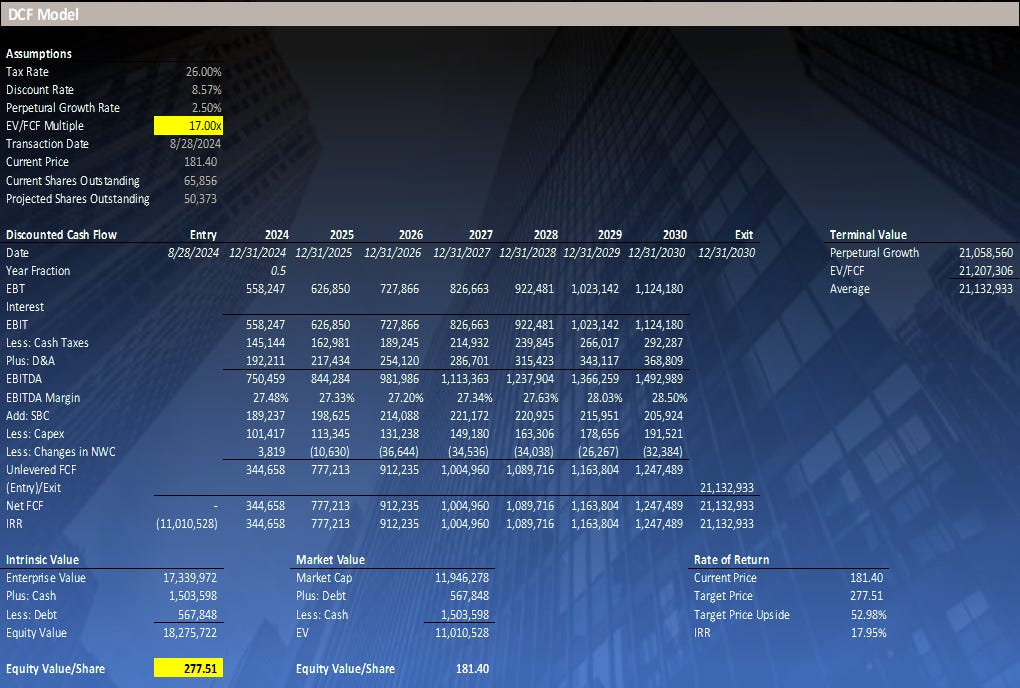

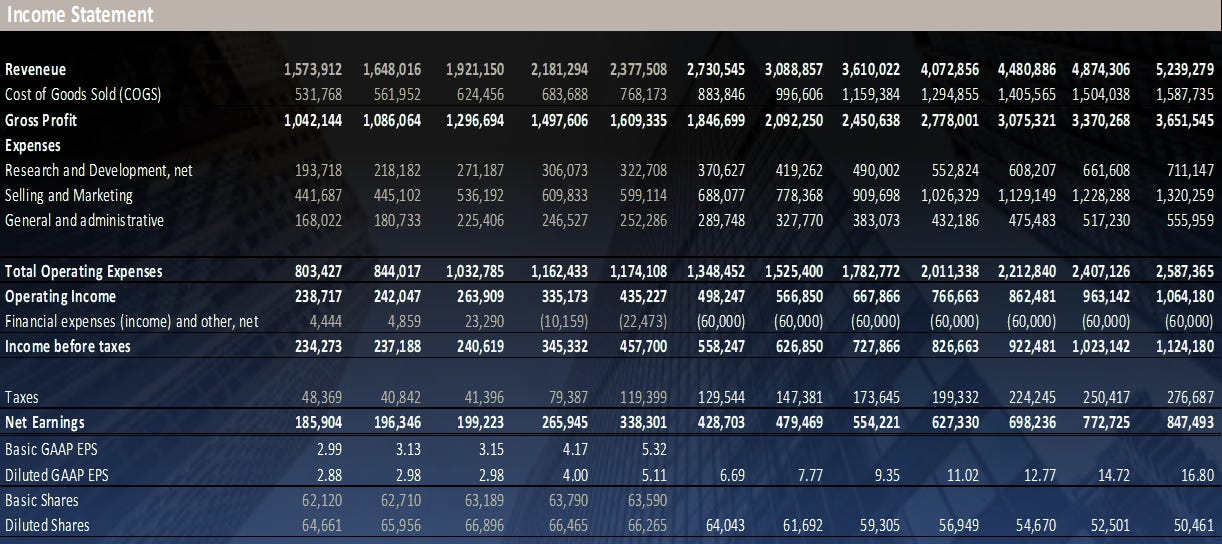

DCF + INCOME STATEMENT

Discontinued Cash Flow Model

Using a discount rate of 8.57% an exit FCF multiple of 17.0x (below median software comps), a long-term growth rate of 2.50%, using the previously mentioned revenue/cost assumptions, and equally weighting exit multiple and DCF method I get to a price target of $277.51/share.

Income Statement Model

POTENTIAL HEADWINDS

A Secular Story with Cyclical Booms & Busts

Some of my favorite long-term ideas come from stocks operating in industries with cyclical booms and busts. However, underneath all that, they have a secular growing story that is often clouded (no pun intended) and dismissed when busts occur. Contact centers fit this description perfectly. Because call agents tend to be employed in industries like hospitality, food service, retail, and similar consumer spending-related sectors, it means that in times when consumer spending declines, a recession, so do the number of contact agents, and if there are fewer contact agents to serve software to, NICE’s growth would slow down. However, looking beyond all this is a world with increasing digital interactions via social media, apps, and many other digital platforms, and more interactions mean that, over time, call volumes/software needs will grow. The digital economy is naturally a GDP+ growth story, meaning that NICE is a GDP+ business without any technological disruption. However, if a consumer spending slowdown occurs, so will NICE growth, and the market will de-rate the stock or let it go sideways until growth rebounds following a consumer spending trough. Another risk worth noting is competition. Genesys and NICE offer the two best product suites, but many companies, such as Amazon and Microsoft, try to compete in this industry.

To sum it all up, NICE will be an immediate inference AI beneficiary where the market is discounting the opportunity driven by one-time unexpected headwinds like the CEO abruptly retiring that will dissipate within the next twelve months (NTM), making it one of the most undervalued “AI stocks” that the market has to offer. I believe that over the NTM shares will reprice to 21.0x FY2025 FCF from today’s 14.1x multiple, implying $270/share, representing ~49% upside.