Front & Center; Long FVR $27 PT

A quick pitch on a newly public REIT with an underpenetrated niche benefiting from Soros's Theory of Reflexivity

Thesis: FrontView (FVR) went public in October CY2024, trading at 10.6x my FY2026 AFFO estimates, with a unique opportunity to roll up an underpenetrated niche, outparcels. Less than 10% of convenience-related real estate is institutionally owned, hence the underpenetrated niche. The lack of public roll-up in this niche provides FVR with a long runway to acquire properties in the high 6s to low-7s cap rates, while FVR's public equity sits today at a 4.8% implied cap rate (NOI based on FY2025e). FVR's only close comp, CURB, also went public a few months ago, and with both being small caps, there is less interest from institutions and less sell-side time spent on the name, which is why I believe my AFFO estimates are higher than consensus by ~15.5% in FY25 and ~25.0% in FY26. FVR shares deserve a re-rating from today's 10.6x FY26 AFFO multiple to 15.0x, slightly below its comp set's median, even though FVR is of higher quality with faster growth than its comps. Taking the FY26 re-rate multiple of 15.0x * my FY26e AFFO of $1.79, you get a PT of $26.91 per share or ~41.6% upside.

Company Overview: FVR went public in October CY2024 and is a net lease REIT with 100.0% of its business focused on outparcel land with direct frontage on high-traffic roads. The best way to picture it is that FVR owns convenience-oriented outdoor retail shopping centers, with ~88.0% of ABR derived from either casual diners (19.3%), QSR (17.4%), automotive stores (10.4%), medical/dental offices (10.1%), FIG (8.3%), cellular stores (7.3%), home improvement (5.2%), car washes (3.6%), other (0.9%), gyms (0.7%), professional services (0.3%). The remaining 12.0% is 8.0% general retail and 4.0% pharmacies (Walgreens <2.0%). Here are a few additional statistics around the business: WALT 7.0 years, >99.0% occupancy, top 10 tenants ~23.0% of ABR, 278 properties across 31 states, NOI converts into AFFO at ~58.0 – 60.0%. FVR is higher quality than most retail REITs, as e-commerce trends cannot displace >80% of tenants. Additionally, since retail construction has seen such outflows since the GFC, an undersupply of high-quality open-air retail like outparcels, has created strong tenant demand. Moreover, another higher-quality aspect of outparcels is the lower capital intensity than traditional open-air retail due to the uniformity in the size and structure of the stores situated on outparcels.

Why is FVR Public Now? FVR was co-founded by Stephen Preston (now CEO) in 2016 as a private REIT. The company generated ~$253.0mm in proceeds from the IPO, with $200.00mm paying down all its ABS notes (cuts interest expense in half), and the remaining being used for acquisitions. FVR reached a size where it needed to tap into the public markets to maximize scale advantages, and with a highly desired niche, the market is allowing them (due to low implied cap rates) to roll up the outparcel space.

Favorable Business Characteristics: FVR has a few qualities, some idiosyncratic, that I believe make it deserve a premium to other net lease retail-focused REITs, but the price target does not consider that premium for conservative reasons. Below are the four characteristics that justify a higher AFFO multiple.

1) Soros’ Theory of Reflexivity: Soros’s theory of reflexivity is about the idea that investors' perceptions of reality can influence reality. FVR is very much akin to this, and almost all REITs are, for that matter. FVR has a very exciting growth story (for REIT standards) that I believe will create a story where investors will provide the company a 4.5 – 5.0% implied cap rate, allowing them to roll up the outparcel market at 6.5% - 7.3% cap rates.

2) A True Interest Rate Tailwind: 100% of FVR debt today is floating, and with the prospects of rate cuts over the next twelve months, FVR is a REIT that truly benefits from Federal Fund rate cuts, whereas most REITs are levered to the long end of the curve that is little impacted by Federal Fund rate cuts.

3) Management Fee Runoff: In tandem with the public offering, FVR completed internationalization, allowing the company to no longer pay property or asset management fees to its predecessor. The fees made up 10.4% of rental revenue in the LTM; without these fees anymore, margins are set to expand on easy comps.

4) NOI Headwind Now In-Line: 3.4% of lease escalations are linked to CPI, 3.4% with no lease escalations, and the remaining 93.2% are fixed lease contractual increases. The weighted average NOI increase per annum for FVR is 1.70%, which has been a headwind since 2021, while inflation ran well in excess of 2.00%. However, now that inflation has returned to the 2s, this headwind has faded.

Why Does The Discount Exist? FVR only has two years of historical data from when it was private, which is highly unrepresentative of future numbers. For instance, the property and asset management fees will no longer exist, which made up 10.4% of rental revenue over the LTM. Additionally, zero properties were acquired and realized on the filings in FY2024, making comps easy going forward. Furthermore, FVR going public gives it an immediate scale advantage to tap public markets at its discretion ($19/share 4.8% implied cap rate) vs acquiring properties in the 7s cap rates. All that said, what the lack of public data on FVR creates is an opportunity where algorithmic traders have not efficiently priced FVR’s relative value. Further, it is under-owned by institutions due to the lack of time being a public company and lack of sell-side coverage (5 analysts cover it).

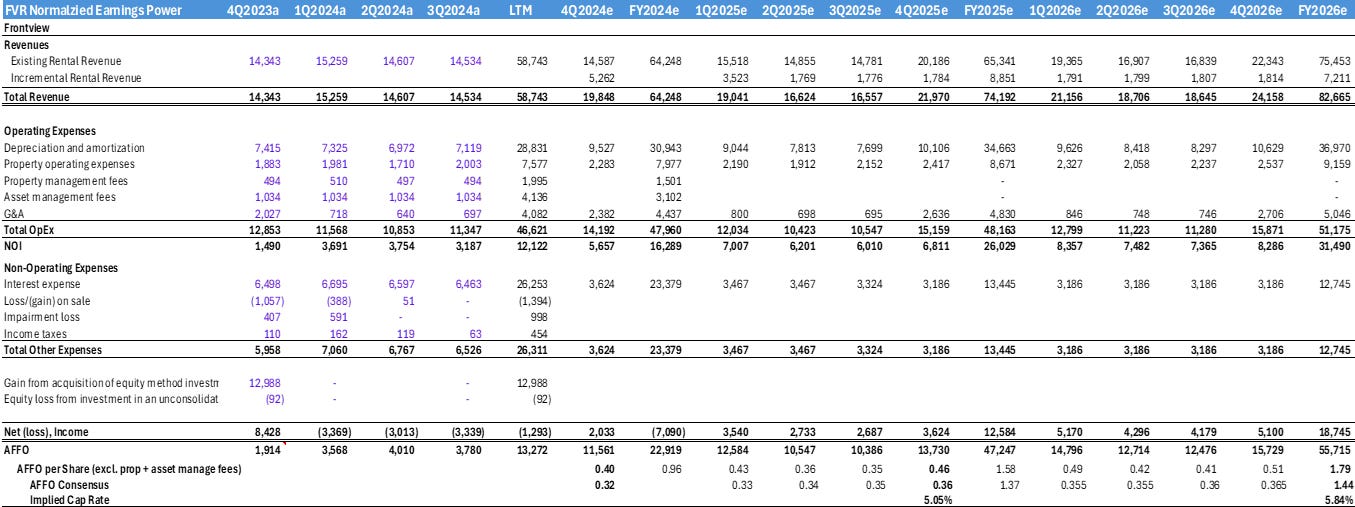

Income Statement + Acquisitions Build: There are a few key assumptions that drive the bulk of the model output (90%+): 1) FVR can acquire $100mm in properties per year, 2) cap rates on these properties are >6.75%, 3) Per time period, costs as a % of rental revenue increase Y/Y at 50% of the rental revenue growth rate. Assuming these three things, you get an AFFO of >$1.75 per share in FY2026 (consensus, $1.44). Below is the income statement I built for FVR. 4) I assume a 4.0% share dilution per annum.

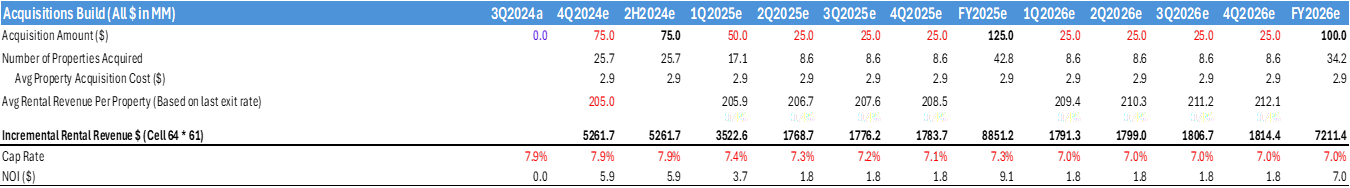

Below is the acquisition build for FVR; a few things to explain: 1) The number of properties acquired is (Acquisition Amount $ divided by Avg Property Acquisition Cost $). 2) Average property acquisition cost is the portfolio’s at-cost acquisitions since inception ($786mm) divided by the number of properties (278) = ~$2.9mm. 3) Avg Rental Revenue Per Property is based on FY2023 rental revenue divided by property count.

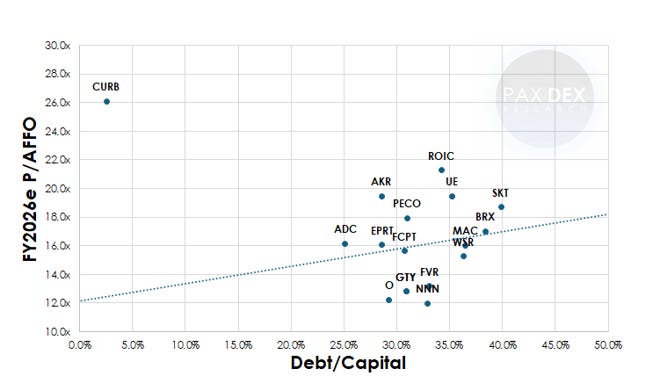

Comp Set: With only one true comp, CURB, I instead choose to do a linear regression on net lease retail REITs with the y-axis being consensus FY2026 AFFO estimates for each ticker and the x-axis the debt/capital ratio on all of these REITs, the by far and away outlier is CURB here due to it being debt free, but since I used median to place the dots, CURB does not skew the data materially. Based on the analysis, FVR should be fairly trading at a 16.0x FY2026 AFFO multiple vs the current ~13.0x, on consensus numbers. On my numbers, FVR is 10.6x FY26 AFFO, but in either analysis, it's clear FVR should re-rate higher. Additionally, I see little reason FVR can't ultimately trade at a premium to comps, as outparcels have higher quality than traditional open-air retail.

Wrap-Up: Risks to the rating are 1) the growth assumptions of >$100mm in acquisition per annum + low 7s cap rates are incorrect 2) inflation reaccelerates 3) more share dilution than the expected 4.0%. Assuming the thesis plays out, I expect a ~41.6% return over the NTM.