NMIH Quick Pitch (No Paywall)

A housing-ish long with a high-teens IRR outlook (assumptions included)

NMIH Elevator Pitch

NMIH is a small cap that has been forgotten as it operates in an industry where investors have had scars since 2008. NMIH trades at a slight discount to comps at 8x next year's earnings for best-in-class credit quality, balance sheet, and growth. I believe NMIH can achieve a conservative mid-teens IRR based on share repurchases, higher portfolio yield, and LSD mortgage origination volume growth. However, it is more likely that NMIH compounds in the high-teens when accounting for higher growth in mortgage origination volumes driven by higher home prices, more new homes and existing homes sold, share gains, and a flat cost base driving margins higher as the top-line grows.

Quick Pitch

NMIH is a private mortgage insurer (PMI); it’s pretty simple to understand but has a lot of intricacies you must forecast to underwrite the business. PMI is required for all home buyers where the loan is greater than 80% of the home value; depending on a buyer's credit quality, PMI will be priced as a percentage of the original loan amount; for borrowers with above a 700-credit score, this will tend to be 0.40 – 0.80% of your original loan amount you pay each year as private mortgage insurance. The average life of a PMI policy is 5 - 10 years, with many factors driving and changing the life of a policy.

The bet you are making when purchasing NMIH is that the economy continues to stay strong with low unemployment, and a mixture of the number of homes sold (PHS + EHS) continues to stay at this level or grow, and home prices don’t crater. I can show dozens of charts as to why I believe the economy and job market will continue to be strong, but for the sake of this being a quick pitch and macro being very binary, you either believe it continues its record expansion or we dip into a recession, and in the ladder scenario, NMIH underperforms.

A commonly asked question is competition? And how could that affect the private mortgage insurance business? Post-2008 mortgage reform, regulators made it effectively impossible to start a PMI business economically. This means the incumbents (NMIH, MTG, RDN, ESNT, ACT) all have a moat against new competition, and the existing structure of a handful of private mortgage insurers works well as competition still keeps prices in check, meaning regulators de-regulating the PMI industry to allow new competition is extremely unlikely.

NMIH is growing the fastest in its industry, which tends to raise red flags for insurance businesses as it could imply lower underwriting requirements to take that share. In NMIH's case, this is not true. The Company has invested a significant amount into procuring its sales team and tech to take share, albeit a very little amount of share. However, a little share means double-digit top-line growth for NMIH given its scale.

Given that NMIH is expanding its policies quickly, regulators require more capital to be held back. But as NMIH's growth slows down, which I believe it will over the next 9 – 18 months, the company will be able to start returning significantly more capital to shareholders in the form of share repurchases and dividends, preferably share repurchases.

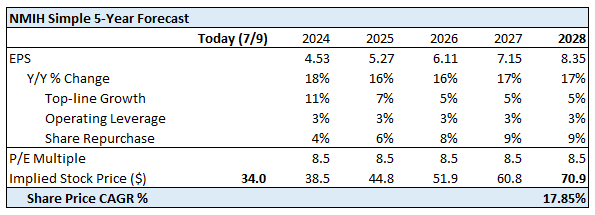

In FY2024, NMIH will buy back ~4% of the company on an earnings yield of ~12%. Once capital requirements start to come down, the company will start returning HSD % of its earnings yield to shareholders. Below are my assumptions that get me to a high-teens IRR. Additionally, the current yield on the NMIH investment portfolio is 2.9%, much lower than the 5.0 – 5.5% yields today; as the NMIH portfolio matures, this will continue to reach 5%.

Assumptions:

Top-line growth (new policies, higher home prices, and portfolio yield are drivers)

Share repurchases increase as growth from new policies shrinks

8.5x P/E (conservative based on the fact that mathematically, for a perpetual zero growth cyclical, you should pay 8.5x earnings; NMIH long-term will grow at GDP)

Unemployment continues to stay low, home prices don’t fall 10%+, PHS + EHS ≥ 0% growth