PaxDex Research Quarterly Subscriber Letter

PaxDex Q1 2024 Returns, Performance Review, and Portfolio Outlook.

Hi all! Below is a Docsend link to the quarterly subscriber in PDF format (much better than Substacks format), but I've also written it out here for those who would like to read it on Substack.

PaxDex Research Q1 2024 Subscriber Letter

Dear Subscribers:

For U.S. equity investors, the first quarter of 2024 was among the best in recent years, with U.S. equity markets returning the best Q1 since 2019. This was all amid the hopes for rate cuts falling, stubborn inflation, and much better-than-expected economic growth driven by fiscal dominance. The lack of sensitivity the federal fund rate (FFR) has on the U.S. economy is evident today in that almost everything U.S. Americans finance is termed out on fixed rates. The only material sector and investors still affected by the higher-for-longer FFR are CRE and regional banks. This past quarter has shown that real estate is still unfavorable on the back of underperforming in recent years, with the XLRE the worst-performing sector in the S&P 500, down 0.55% in Q1. Moreover, regional banks via KRE were down 4.41% in Q1. On the back of higher inflation and oil up 18.09% YTD, energy equities were the second-best sector in the S&P 500, with the XLE up 13.69% YTD. Furthermore, in the early innings of a business CapEx boom, technology stocks were among the best performers, notably names like NVDA, SMCI, and AMD. Communication Svcs and Technology were up 15.82% and 12.69%, respectively, in Q1.

In Q1, we received updated Federal Reserve projections that showed the neutral rate rise from 2.5% to 2.6%, and three rate cuts were still expected, though just barely. More importantly, the FED upward revised 2024 core PCE target from its initial projection in December 2023 of 2.4% to 2.6% and GDP growth from 1.4% to 2.1%. This substantial increase in nominal growth was reflected in the bond market with significant underperformance in Q1, down 3.75%, via TLT. PaxDex was long stocks and bonds in Q1 and remains with that tone moving forward, though the trade might be in for a cooldown and consolidation. PaxDex’s largest bet, U.S. residential construction, which I am playing through BLDR, OC, and others. Performed exceptionally well in the quarter, with the XHB (closest gauge) up 18.11% in Q1. Loose financial conditions generated by the FED, mortgage rate buydown arbitrage through Freddie Mac, and chronic housing shortage are slowly being realized by investors. We still think this trade has more upside, but consolidation is expected due to the rapid price appreciation. While a giant bubble in history is being built, the U.S. government debt bubble, PaxDex finds ways to profit off it and ignore the rabbit holes in the near term debating about when it will pop, as evident from Jerome Powell and other FED speakers, the time is not now, and it may not be for another decade.

Returns:

PaxDex generated a 15.83% return in the first quarter, outperforming the S&P 500 return of 10.56% and Russell 2000 of 5.18%, per FactSet. PaxDex runs at 70 – 85% SMID cap exposure on average, so PaxDex’s correct benchmark leans towards the R2K; however, we compare it to the S&P 500, knowing this is what most investors look at daily. Additionally, PaxDex runs with <10% exposure to technology stocks and 0% exposure to semiconductors. My focus is on industrials and industrial-related equities.

Performance Review and Portfolio Outlook

As mentioned earlier, PaxDex’s housing-related bets performed the best, all up at least double-digit percentage points, with IESC up the most, 53%, since I went long in January. In Q1, the first buy-rated equity research report PaxDex shared was on ticker CNM on Jan 4th; since then, the stock has been up 47%. PaxDex’s most considerable underperformance was early in Q1 due to Kilroy Realty (KRC); I added to the Kilroy long in October 2023 with the belief that the hiking cycle was coming to a close and the class A office real estate Kilroy holds were going to be able to weather the current CRE freeze. Over the subsequent months, the thesis played out, with the position up 40% by December. However, I failed to realize the peak expectation for rate cuts was then. I didn’t close the trade until late January, losing a substantial portion of the returns and closing the position for a 20% return instead of the 40% it could have been. Moving forward, I expect stocks to continue consolidating or grinding higher until inflation inflects higher, an event in which I believe stocks and bonds would correct materially lower.

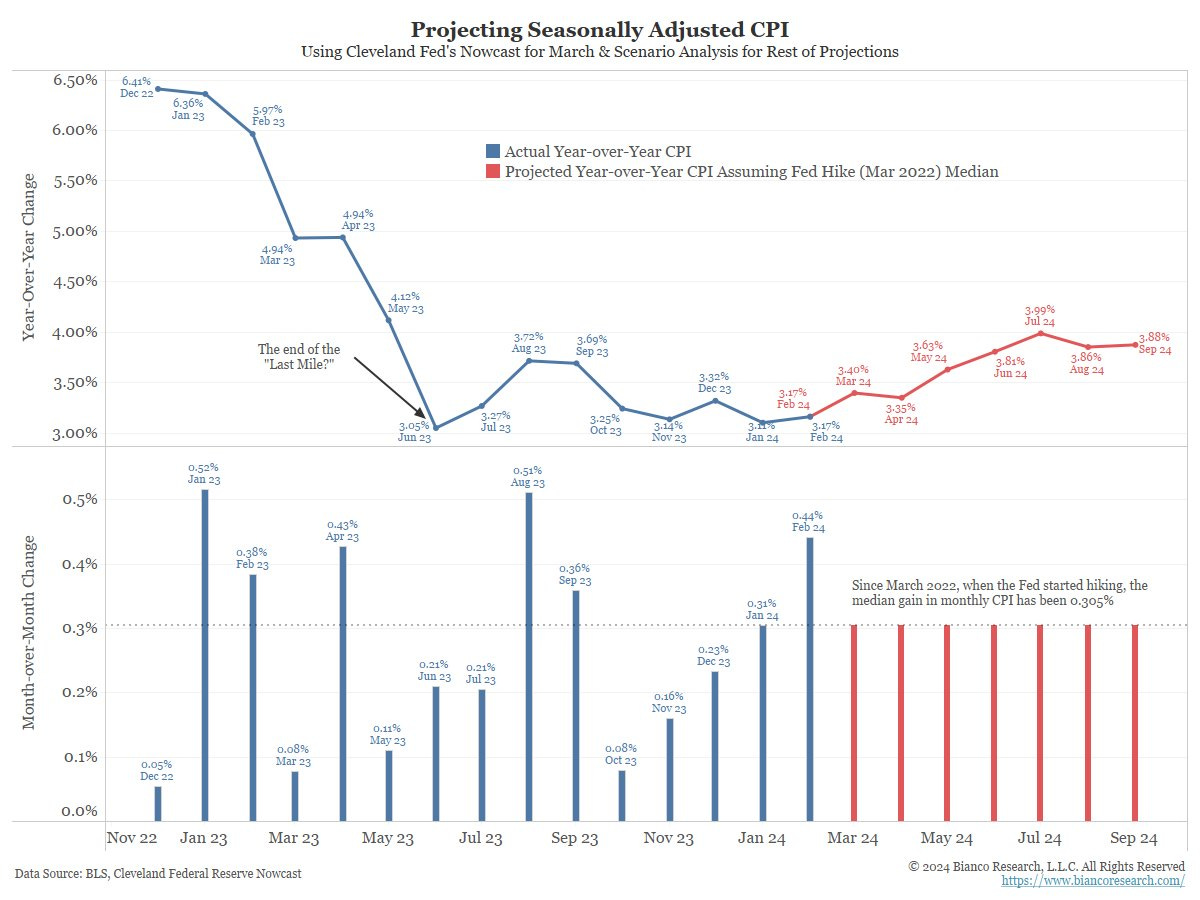

Begging the question of when inflation reaccelerates? In Q2, CPI and PCE will lose their “easy comps” starting in June shown in the graphic below. Equity and bond markets have not priced in 3%+ inflation.

In my view, it's hard to believe inflation can stay below 3% with nominal growth the highest since the GFC, which is being driven by effects that have yet to change, the two largest of which have significant downstream impact: fiscal deficits and loose financial conditions. To me, it's odd that the FED is currently calling for three rate cuts in 2024 yet has an inflation target of 2.6% (Core PCE) for 2024, which is above its 2% target. In any event, remaining short bonds, long select stocks, and a mix of cash is the best portfolio composition right now. As always, feel free to reach out to paxdexresearch@gmail.com with any questions.

Best Regards,

PaxDex Research