TOST FY1Q25 Earnings Recap (No Paywall)

Toast is exceeding expectations on all fronts: top/bottom-line, upmarket expansion, payment take rate growth driven by surcharge, and more

Toast (TOST) Earnings Recap & Notes

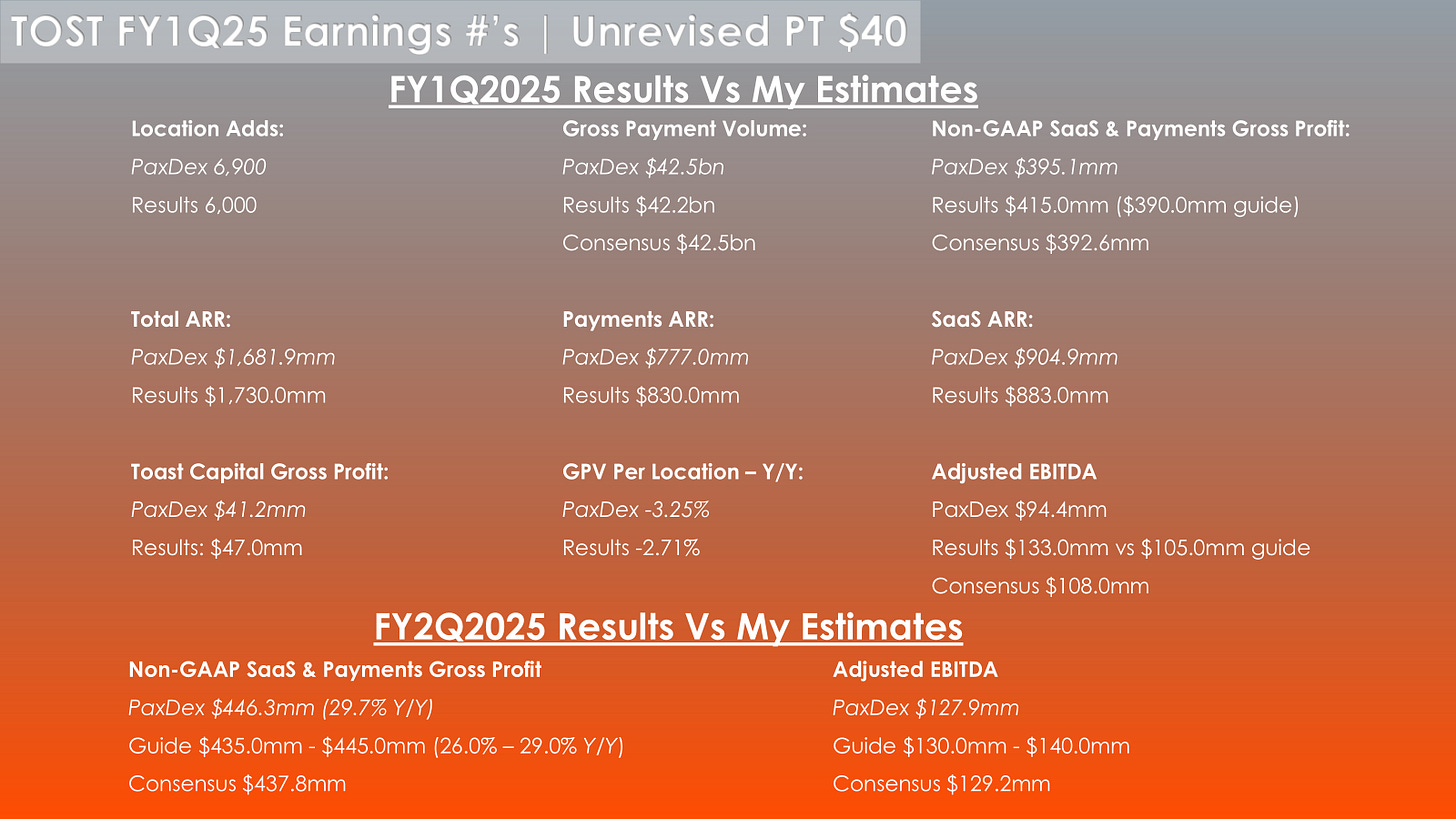

After the bell, TOST reported its FY1Q25 earnings, with expectations coming above sell and buy-side expectations. The Company raised its FY25 Non-GAAP Recurring Gross Profit guide from 23-25% growth y/y to 25-27% growth y/y, raised its AEBITDA range for FY25 to $540mm - $560mm, up from $510mm - $530mm. Furthermore, 1Q25 Non-GAAP Recurring Gross Profit beat consensus by 5.7%, an acceleration from last quarter's 3.6% beat. Notably, payments net take rate was up 4.7bps y/y, driven by the new surcharge initiative (which I wrote up extensively in my initial coverage launch starting in November 2024), pricing increases on old cohorts, and cost optimization. I continue to believe that the take rate has further upside, driven by surcharge adoption, where Toast is behind its other cloud POS provider peers, proving it’s in the early innings for growth. Lastly, it's worth noting that this quarter had one less selling day due to lapping leap year, and wildfires disrupted one of Toast's core markets, SoCal, and yet GPV per location decline improved sequentially to -2.71% y/y from -3.31% in FY4Q24. All around, this was a very strong quarter, and Toast continues to show its dominance in becoming the #1 restaurant technology provider in the United States.

Summary:

Near-term numbers will be revised higher, and the FY25 gross profit and AEBITDA guide implies significant room to be raised further with the current gross profit guide assuming that growth slows 13pts for the remainder of the year, which, absent a massive shock to Toast’s business/industry, will not occur.

Payments product offerings (surcharge) are driving its take rate higher with significant white space to further grow adoption, with my estimations that <1.5% of Toast locations are using the product thus far.

Macro has had little to no impact on Toast's business YTD, and GPV per location (in light of a leap year comp/SoCal wildfires) grew sequentially, driven by a combination of a resilient consumer and a mix shift to enterprise/bigger deals like signing Topgolf.

Key Points:

Payment Take Rate Growth | Surcharge Initiative

Payment net take rate was up 4.7bps y/y in 1Q25, driven by surcharge, pricing cohort increases, and cost optimization.

In September FY24, Toast launched its surcharge product with a 30-day notice to use the product; no impact was in the 3Q24 financials. However, in 4Q24, payments net take rate grew 4.6bps y/y, and this quarter grew 4.7bps y/y.

For context, I estimate that locations that opt into surcharge have an incremental net take rate somewhere between 125 - 225bps, while locations that do not opt into surcharge have a net take rate of 45 - 50bps. Additionally, every 1.00% (1,280) locations that opt into surcharge provide incremental payments gross profit of $38.4mm per year. In other words, every 1.00% of locations that adopt surcharge will provide 2pts of growth to FY25 gross profit.

Wall of Worry | Macro Impact Nonexistent

Management noted several times that the current macro regime is generally supportive of Toast’s upselling and outbound sales teams, with consumer spending continuing its mostly unabated growth for the past 5 years. And as I mentioned earlier, even with headwinds in this quarter related to GPV per location, it accel’d q/q.

Upmarket | Applebee’s & Topgolf Proof Points

This quarter cements the beginnings of Toast's push upmarket into enterprise by signing Applebee's and Topgolf, with the former being the Company’s largest deal of all time. Toast believes the reasons why it won Applebee's were driven by its leading handheld product offerings, kitchen display services, and wanting the most modern tech stack available. Enterprise deals like Applebee's tend to come at a higher GPV per location, and management said they have not been dilutive to overall Toast ARPU. There are 1,500 Applebee locations, and the parent company, Dine Brands, owns IHOP and Fuzzy’s Taco Shop, which collectively represent ~3,500 locations. Fuzzy’s Taco Shop (~150 locations) is running on NCR Aloha, and IHOP just finished its 2-year migration to TRAY Point of Sale.

The Topgolf deal is interesting and is one of the first proof points that Toast can win in more retail/expericence-centric industries. Management noted that those who competed in the RFP were generally the legacy providers, and that this deal has a significant uptick in overall GPV/ARPU/ARR per location metrics.

I’ve modeled little to no opportunity for Toast in the enterprise due to Toast's inflexibility with product offerings, often mandating payments, but always its point of sale system. However, I’ve been surprised that this has not been the case, and enterprises are willing to use Toast's point of sale, payments, and other software product offerings combined.

Highlight | OpEx Growing Slower Than Expected

Toast OpEx came in much lower than I expected, and it's the primary reason my AEBITDA estimate was ~$30.0mm lower than the results. Driven by R&D expenses being flat y/y vs my expectation of them being up in the high teens %. S&M and G&A came in-line with my expectations.

FY25 Guide: Further Upside Driven by Conservative Assumptions

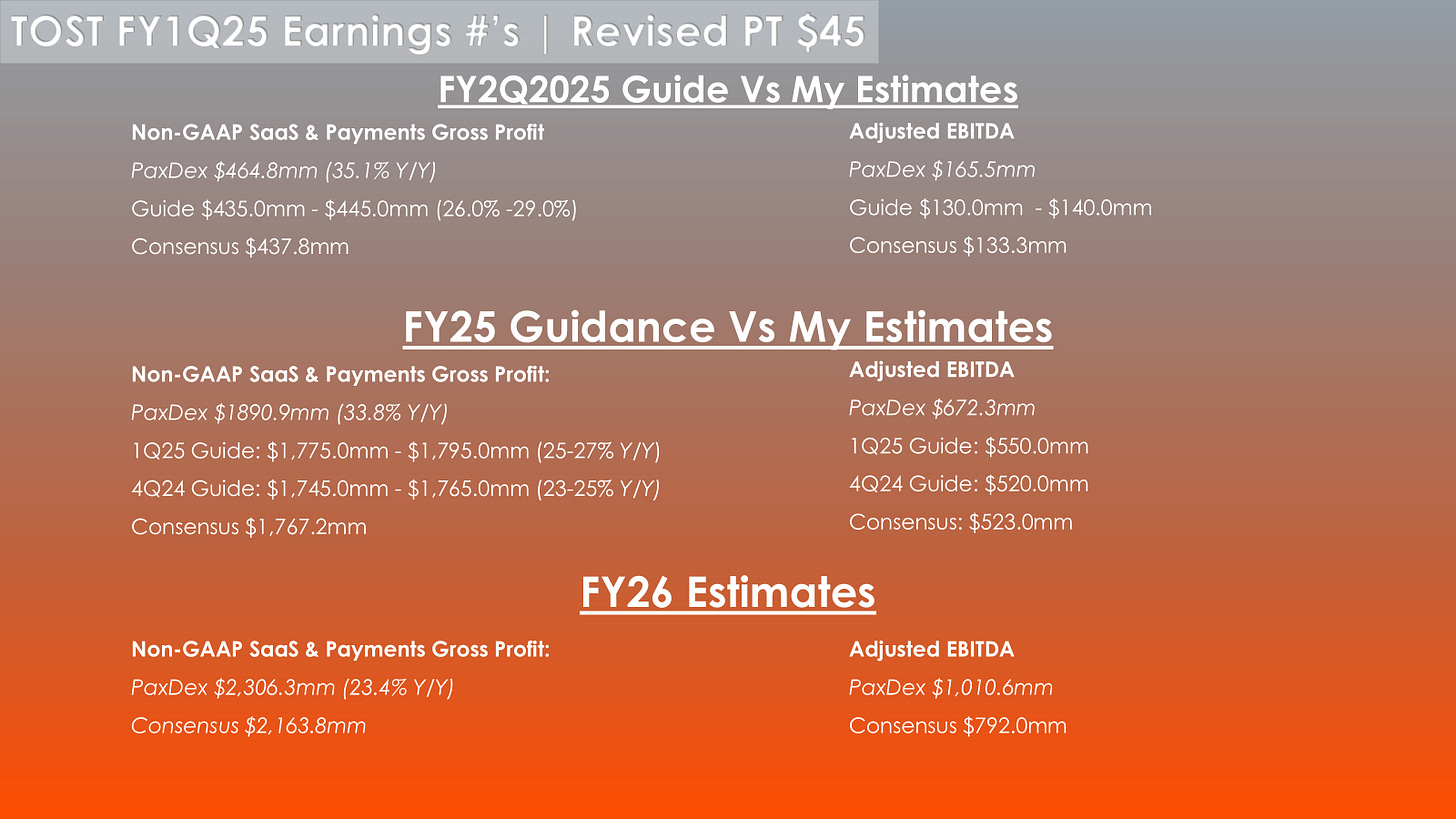

Toast FY25 Non-GAAP Gross Profit guide at its midpoint of $1,785mm (26% growth y/y) assumes that growth for the remainder of the year will be 23.2% y/y, for comparison, in 1Q25, Toast grew this metric 37% y/y. Comps become 3.4pts easier in 2Q25, 6.1pts tougher in 3Q25, and 4.5pts tougher in 4Q25. While 2H25 comps will be harder to have the magnitude of growth seen in 1Q25 of 37% y/y I find it highly unlikely that for the remainder of the year Toast will only grow at 23.2% y/y (which would mark it at the mid-point of the FY25 guide) therefore implying that Toast has significantly room to raise its FY25 guide higher. On my estimates, Toast will grow Non-GAAP Gross Profit by 31.9% y/y in FY25, or 5.9pts higher than its current midpoint growth rate of 26% y/y.

My price target increases from $40 to $45 per share. Reach out if you'd like to see my assumptions and/or model behind the price target.

Earnings Call Notes (Q&A):

How should we consider the payback periods for large deals like Applebee's, which involve 1,500+ locations? What are the sales and marketing (S&M) costs and other resources required to recoup the investment? The payback period for Toast as a whole is ~15 months. How do the bigger deals fit into this timeframe?

Because the ARR is so significant in these larger deals, the payback period is lower

Additionally, the churn tends to be lower for enterprise

ARPU was healthy in this Applebee's deal relative to the overall Toast ARPU

Are enterprise deals opting for payments?

Generally yes, and even if they don’t, the economics are attractive

How do you think about macro at the moment?

Same-store sales remain stable and have continued through May

Sales productivity is up y/y, proving that macro hasn’t impacted Toast

Could you talk about pricing increases as an opportunity going forward with the macro softening?

The primary focus is on growing attach rates and location accounts. Meaning, pricing is the last lever being pulled for growth

Update on broader roll-out/timing/monetization on new AI-related products?

Very early in these products, we are currently laying the groundwork internally to enable/build these products

Restaurant customers are not tech savvy, so a big part is making the customer know why these products are valuable and can save a restaurant's time

Update on international/oUSA expansion. How is it going?

Traction being seen internationally has been strong, and GPV per location isn’t much different than the U.S. so far

The U.S. playbook of referral channel/flywheel in cities will work well in oUSA cities, but it’s still very early

DoorDash is a potential emerging competitor. How do you view partners becoming new competitors?

Toast believes that its platform has and continues to have the ability to invest more than others to have the most comprehensive tech stack available for customers

If we were to enter a recession, how would you think about managing your operating costs with revenue growth slowing?

If pressure were to be seen, Toast would pull back spending quickly in non-revenue-generating operating areas

Are there additional opportunities to explore in the enterprise?

The pipeline in enterprise has never been stronger, and adding customers like Applebee's continues to build Toast's proof points

Can you help us understand the pitch to Applebee's and why Toast was chosen?

Part of it is when you think about Applebee’s footprint, they love handheld offerings where Toast excels, and KDS tools, they want to be modernized

Enterprise is an end market where investors have been skeptical, where you could win, but is this a deal that will lead to more?

Yes, the backlog in enterprise has never been bigger

Software ARPU was strong in the quarter did anything drive that?

Management didn’t add much

What is the pricing strategy for Toast IQ and AI-related products?

The focus isn’t on pricing right now, but rather on educating customers to stay up to date on the trends of AI and how it can help restaurateurs

As you start to stack up more enterprise restaurants, are legacy vendors acting any differently?

No, not really, the focus for Toast continues to be how they can support enterprise

What is your confidence on 2Q location adds given the current macro?

Sales productivity was up y/y, and nothing really incremental that has changed in the past few months in terms of the selling environment

Take rate ex. Capital moved up in the quarter. What drove this?

Take rate was up 4bps y/y in 1Q25, driven by a combination of pricing initiatives in Fall 2024, cost optimization, and some product surcharge driving take rates higher

Does the impact of tariffs have any impact on hardware costs, and would this elongate payback periods?

The incremental costs with current tariffs are manageable and baked into the FY25 guide

Over the last few years, Toast has diversified its supply chain to make it less reliant on China

For the location growth algorithm, what is it?

The share between new and existing is balanced, and the core United States continues to be the primary growth driver, but longer-term this will gradually switch to oUSA/F&B

Can you talk about the Top Golf deal and who you competed with to win this deal?

Competition was more legacy in this deal, and the value proposition to Top Golf was Toast can power the food, beverage, and golfing experience where most could not

These types of deals have much higher GPV per location

Have you seen any changes in the creditworthiness in restaurant locations?

No change and default rates are in line with expectations